OxfordPV

Dr Henry Snaith wins Paterson Medal

Dr Henry J Snaith, Clarendon Laboratory, University of Oxford.

For his important contributions to the field of excitonic solar cells.

Henry Snaith is a leading figure in excitonic solar cell research and in organic and hybrid optoelectronics. His activities range from nanomaterials synthesis through to device fabrication and optimisation, optical spectroscopy and theory. He has studied a number of device systems including LEDs, polymer lasers, polymer solar cells and transistors, but focuses his efforts on solid-state dye sensitised solar cells (DSSC). DSSC technology has a real chance of becoming a major future power source, with very low basic materials and processing cost. Snaith has made significant contributions to the study of charge generation and transport mechanisms in polymer blend, hybrid and dye-sensitised solar cells: he has introduced new device concepts and new optoelectronic methods to analyse these nanocomposite materials….

Revolymer

Successful IPO:

We are very pleased to announce the first IPO from our UK Tech Fund I. After a hugely successful roadshow Revolymer plc has today announced a conditional placing of new ordinary shares with institutional investors to raise gross proceeds of £25 million and that the admission of its entire issued share capital to trading on the AIM market of the London Stock Exchange plc is expected to take place on 10 July 2012.

The IPO was priced at the top of the indicative range, and represents an 8% premium to the price at which we invested in April 2011 – a 55% premium including initial tax reliefs for our investors, against a backdrop of the FTSE SmallCap Index losing 10.3% over the same period*.

Arvia

Takes decontamination solution to Japan

North West technology company Arvia has been asked to take its water treatment technology to Japan as part of the cleanup of nuclear waste. Asia market access specialist Intralink will support Arvia with a bilingual team, and assistance in establishing a local office. Arvia’s multi-award winning method of water treatment removes and destroys toxic non-biodegradeable contaminants, with one of the major applications being the disposal of organic radioactive waste. Martin Keighley, CEO of Avria, said: “Japan has a big problem with low and intermediate level radioactive oil which is notoriously difficult to dispose of. “Current methods include incineration and encapsulation which can both have a serious impact on the environment. “Neither of these solutions is ideal, and our technology is unique in that it enables the clean, safe and cost-effective disposal of radioactive waste – something of a holy grail for the nuclear industry.” Following successful trails at the Magnox nuclear decommissioning site in Trawsfynydd in North Wales, Arvia recognised the need for the solution in Japan. Low and intermediate level organic radioactive waste is becoming increasingly problematic at a number of sites in the country. Huw Thomas, MD of Intralink Japan, said: “Arvia’s unique treatment technology is ideally positioned to help solve some of the problems in the nuclear industry here. “Intralink’s Surrogate Sales Program will enable Arvia to enter this market and engage quickly with the leading Japanese players in nuclear and other waste treatment applications.”

Tracsis

Further positive trading update

Tracsis, a developer, supplier and aggregator of resource optimisation, data capture and reporting technologies to the transport industries, confirms that based on unaudited management accounts to the end of period 9 (for the year ended 31 July 2012), the directors consider it likely that the Company will exceed current market expectations and a further trading update will be provided as soon as more complete information is available.

For more information please contact:

| John McArthur, Tracsis plc | Tel: 0845 125 9162 |

| Katy Mitchell, WH Ireland Limited | Tel: 0113 394 6618 |

Fund Managers Comments

EC approves EIS investment limit to £5m

The amount of money investors can put into high-risk yet high-growth companies while still claiming generous tax reliefs has more than doubled after the European Commission formally approved government plans outlined in the Budget.

Raising the investment limit from £2m to £5m for the enterprise investment scheme and venture capital trusts, as well as allowing medium-sized and small companies to benefit from the tax breaks, will help an additional 800 companies a year get extra funding, according to Treasury forecasts……

University of Cambridge Enterprise Fund Launch

University of Cambridge launches new investment

scheme for start-ups

Cambridge is launching a new investment scheme that will help support new companies connected to the University.

The new fund, a Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS) fund, will enable individuals to invest in new companies, while benefitting from generous tax incentives.

Cambridge is the first university to launch its own SEIS fund, and the first to combine the SEIS with the more established EIS. The fund will be managed by London-based investment firm Parkwalk Advisors, with investment advice provided by Cambridge Enterprise, the University’s commercialisation arm.

Cambridge is Europe’s most productive technology cluster, having produced nine companies valued at more than $1 billion, and two (ARM and Autonomy) valued at more than $10 billion. The vast majority of the more than 1,500 companies in the cluster are connected to the University in some way: they are either based directly on University research, are founded or staffed by Cambridge graduates, or work collaboratively with University researchers to find solutions to business problems.

The University has an excellent track record in spinning out successful companies: the current equity portfolio of 68 companies has raised more than £800 million in funding since 1995, representing a leverage of 75 times the University investment.

“Cambridge has a key role to play in an innovation-led recovery in the UK,” said Professor Sir Leszek Borysiewicz, Vice-Chancellor of the University. “This fund will dramatically increase the University’s ability to spin out successful companies, and enables individuals to invest alongside institutional funds in order to maximise returns.”

“Parkwalk Advisors is delighted to be able to assist the University of Cambridge in raising capital to fund investment in early stage companies in the Cambridge cluster and thereby leverage the high quality research conducted at the University,” said Alastair Kilgour, Founder, Parkwalk Advisors.

The SEIS was announced by the Government in the 2012 Budget as part of its strategy for stimulating economic growth. In addition to providing individual income tax relief of 50% of the amount invested, any gains on shares held for three years under the scheme are free from capital gains tax (CGT). In addition, during the 2012/13 tax year, gains realised on other investments that would otherwise be liable to CGT will also be exempted from that CGT if they are reinvested in SEIS.

The SEIS is an extension to the EIS, and together the schemes enable individual investors to work cohesively with institutional investors and spread their investment across a range of companies.

“While our companies have been very successful in attracting funding once they are well-established, the lack of access to early-stage funding is a major concern for very young companies,” said Dr Anne Dobrée, Head of Seed Funds at Cambridge Enterprise. “This scheme is an excellent way for alumni and friends of the University to invest in Cambridge start-ups and be a part of the continued success of the Cambridge cluster.”

The University is aiming to raise £1 million to establish the fund, which will work alongside existing University seed funds. Last year, Cambridge Enterprise reviewed 54 new business ideas and made 11 investments totalling £640,000.

-ENDS-

For more information please contact:

Sarah Collins, Cambridge Enterprise, University of Cambridge

Tel: +44 (0)1223 760335

Mob: +44 (0)7500 883612

Email: Sarah.Collins@enterprise.cam.ac.uk

Parkwalk Advisors

Tel: +44 (0)20 7759 2285

Email: funds@parkwalkadvisors.com

For more details, please visit www.parkwalkadvisors.com

Notes to editors:

Past investments by the Cambridge Seed Funds include Solexa (acquired by Illumina in 2007 for $600 million), and Entropic (acquired by Microsoft in 1999). Current investments include BlueGnome and Horizon Discovery, two of the fastest-growing companies in the UK. Both companies recently received the Queen’s Award for Enterprise, the UK’s most prestigious business award. Other successful Cambridge companies with connections to the University include Ubisense and RealVNC.

Cambridge Enterprise Limited is a wholly owned subsidiary of the University of Cambridge, responsible for the commercialisation of University intellectual property. Activities include management and licensing of intellectual property and patents, proof of concept funding and support for University staff and research groups wishing to provide expert advice or facilities to public and private sector organisations. Cambridge Enterprise provides access to angel and early stage capital through the Cambridge Enterprise Seed Funds and Cambridge Enterprise Venture Partners, and offers business planning, mentoring, and other related programmes. Over the past four years, income from licensing, consultancy and equity transactions exceeded £37 million, of which £30 million represents distributions to University departments and academics.

Parkwalk Advisors invests in, and raises capital for, innovative UK technology companies. The Firm manages a series of technology funds, which predominantly invest in companies spun out of UK Universities and other research-intensive institutions. The Parkwalk UK Technology EIS Funds offer individuals unique access to high calibre investments in British innovation. Parkwalk manages investments for HNWs, UHNWs, Family Offices and Wealth Managers, attracted by the quality of the companies, their provenance, and the substantial tax incentives associated with making these investments EIS compliant.

Parkwalk invests in UK innovation and technology across the spectrum, from seed through to AIM listed securities, and has fully invested its first two Funds with the third Fund currently investing.

Parkwalk’s portfolio can be viewed here.

Xeros

Debuts in ‘Home of the Future’

Xeros debuted its revolutionary, environmentally friendly cleaning process on Channel 4 in a new series that shows how an ordinary Sheffield family can use cutting edge technologies and gadgets to tackle challenges such as energy and water use, as they seek to adapt to low carbon living. The series follows the Perera family at ‘work, rest and play’ and shows what they might eat, how they might travel, stay healthy and power their homes in the future. It poses various challenges to the family and offers a glimpse into what solutions are available now and in the future. Xeros featured in a programme titled ‘Work,’ which aired on 19 February 2012 (19.30, Channel 4).

Bill Westwater, Chief Executive of Xeros welcomed Channel 4 to the company’s R&D facility at the Advanced Manufacturing Park in Sheffield in August last year, to show how the technology transforms the way clothes are cleaned by a process that uses polymer beads to ‘attract’ stains. The gentle flow of small polymer beads acts just like hand washing, tumbling with the washload and transporting stains off garments to be locked into the bead molecular structure. This exceptional environmental system uses only a fraction of the water, energy and detergent that is required for conventional cleaning.

Bill Westwater, Chief Executive Officer of Xeros, said: “We were delighted that the programme makers chose to feature Xeros technology in action. The programme aims to tackle serious challenges to British households facing up to rising energy and water bills and how they can take affordable steps to live in more sustainable ways.”

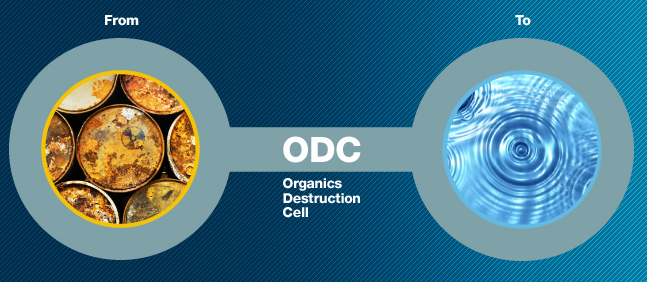

Arvia

Parkwalk closes Arvia investment for the UK Tech Fund II

Arvia represents a dramatic change from the traditional methods for treating organic liquid waste.

This ‘game changing’ technology removes and destroys organic contaminants and oils using a method that is free of process chemicals, is energy efficient, and produces little solid or liquid waste for disposal.

Lime Micro

FPGA-based design kit for multiple wireless protocols

Lime Microsystems has developed what it calls a universal wireless communications toolkit which it claims allows developers to create wireless protocols of different complexities. The toolkit comprises Lime’s configurable transceiver board linked to an Altera FPGA design kit via a high speed mezzanine connection (HSMC) interface board. “We believe, this will lead to the development of novel wireless networks at fraction of the cost and time to market,” said Ebrahim Bushehri CEO of Lime. The intention is to support the development of wireless applications ranging from consumer and enterprise broadband equipment through to bespoke white space, military and GNU Radio applications. “Leveraging Lime’s Universal Wireless Communications Toolkit along with our family of tailored 28-nm FPGAs allows designers to rapidly create communications systems optimised for their specific requirements,” said Mike Fitton, senior architect in Altera’s communications business unit.

Lime’s LMS6002D is a fully integrated multi-band, multi-standard single-chip RF transceiver for 3GPP (WCDMA/HSPA and LTE), 3GPP2 (CDMA2000) and WiMAX applications.

It can be digitally configured to operate in 16 user-selectable bandwidths up to 28MHz. In addition to small cell base stations, Lime’s customers are using the IC to create machine to machine (M2M), GNU radio and white space radio applications.

The Lime HSMC interface and transceiver boards are available via Lime Microsystems with FPGA design kits available from Altera.

ACAL Energy

Shows New Fuel Cell Stack Design

Cheshire, UK – 14th March 2012 – ACAL Energy attracted a lot of interest at the FC EXPO show recently, when it unveiled a new, compact, low cost fuel cell stack design with a rated power of 12 kW and a power density of over 1 kW per litre. The new design is six times smaller than the previous generation, and is expected to be of interest in both automotive and stationery power generation applications.

The design was shown as the company exhibited its platinum-free fuel cell technology at FC EXPO in Japan where a total of almost 100,000 visitors had the opportunity to see it. The annual FC EXPO show is the world’s largest exhibition and conference specialised in Hydrogen & Fuel Cell technology.

The ACAL Energy stand was buzzing with interest from both suppliers and integrators from all around the world, who were keen to hear of the progress being made with its FlowCath® technology. FlowCath® is becoming well known as a means of replacing the precious metal catalyst found in conventional fuel cells with a proprietary low cost liquid catalyst. This inherently eliminates many of the causes of lost performance in both continuous operation and in auto cycling.

“Asian markets, and Japan in particular, are important to us as we develop our commercialisation strategy”, said Bob Longman who was present at the show. “Our compact 12kW design clearly addresses the need for higher power fuel cell engines with reliability built in to the design.”

The ACAL Energy stand at FC EXPO was jointly organised with the Japanese company Sumitomo, which is an investor in the company. FlowCath® technology has the potential significantly to reduce the future cost for vehicle OEMs, and system integrators planning to deploy fuel cells in mass markets. FC EXPO 2012 was part of World Smart Energy Week 2012 which occupied the whole of the Tokyo Big Sight exhibition venue and pulled together a wide variety of cutting-edge technologies in ‘smart energy’ sectors.

Tracsis

Very strong performance

Highlights:

· Increase in revenue to £3.66m (H1 2011: £1.24m), reflecting very strong trading performance across the Group

· Adjusted EBITDA* increased to £1.26m (H1 2011: £180k), with Profit Before Tax of £1.13m (H1 2011: £127k)

· Basic Earnings per Share increased to 3.47p (H1 2011: 0.47p)

· Healthy balance sheet maintained. Cash at bank now stands at £5.95m and the business remains debt free. The Group generated £1.26m of cash in the six month period

· Strong visibility on H2 order book resulting in management expectation that full year outturn will exceed current market expectations

· Due to strength of trading and general outlook going forwards the Company announces payment of an interim dividend of 0.2p per share. This maiden dividend signals the adoption of a progressive dividend policy.

· The Group continues to appraise new acquisition opportunities as part of the Company’s broader strategy to consolidate/aggregate complimentary businesses within the optimisation and data capture/reporting field.

John McArthur, Chief Executive Officer, commented:

“These interim results reflect the Group’s continued growth and maturity as a diversified technology company with both revenues and profits increasing significantly against the same period last year. The contribution made by MPEC Technology Limited has been a significant boost and we believe their success demonstrates increasing strength and depth with our market offering. Trading across the rest of the Group has remained strong and Tracsis continues to boast a healthy balance sheet. We remain excited about further growth opportunities, both organic and by way of acquisition.

As a result of recent trading, profitability and general outlook, Tracsis will initiate the start of a progressive dividend policy which our Board believe is sensible and sustainable. This policy endorses our success achieved to date and also our strong belief in the future growth of the business.”

Surrey NanoSystems

Scientists researching the ‘darkest material known to man’ are hoping a new manufacturing process will enable them to create more accurate space instruments.

The British companies developing the production method say it could make NanoBlack — a coating based on carbon nanotubes — more flexible and widely used, following a new research project match-funded by the government…..

Surrey NanoSystems

Parkwalk closes Surrey Nano Systems investment for the UK Tech Fund II

Surrey NanoSystems has developed a leading technology portfolio addressing the needs of the global nanoelectronics sector.

Its proven technologies deliver precise, ordered nanomaterial structures for advanced CMOS manufacturing processes.

ACAL Energy

FT: UK seeks to keep lead in fuel cells

Britain is staking its claim to lead the race to find a carbon-free car engine by bringing two innovative hydrogen power companies together.

Acal Energy, which has developed a cheap fuel cell, and ITM Power, an Aim-listed maker of hydrogen for fuel, have been given £500,000 – with the promise of up to £5m more – by the Carbon Trust, a government-funded body, to combine their technologies to create the breakthrough needed for mass market scale. They are working with an unnamed Japanese carmaker……

Revolymer

Rev7 removable gum premiers in EU

Following the approval of the European Food Safety Authority, Revolymer® announces Rev7™ gum distribution deal with Topaz fuel stations

Revolymer® Ltd the revolutionary British polymer company is delighted that the European Food Safety Authority (EFSA) has fully approved its revolutionary Rev7™ gum for sale within the EU and has already secured its very first European distribution with Topaz, Ireland’s largest fuel and service station group.

The deal means that great tasting and environmentally friendly Rev7™gum will be available from May at over 114 forecourt stores across the Republic of Ireland. With this major distribution partnership now secure, Revolymer is now actively seeking further retail partners and hopes to have its gum on-shelf in the UK by autumn of 2012.

As the world’s first commercially available environmentally friendly gum, Rev7™ is a real game changer in the competitive European gum market. Using patented polymer technology the gum can be removed readily from clothes using soap and water, and the streets.

In the Republic of Ireland chewing gum is the single largest component in the food litter category and the second largest component of overall litter after cigarettes. The numbers speak for themselves; in one month Dublin city council removed an estimated 180,000 pieces of embedded gum from Grafton Street, the city’s premier shopping thoroughfare, while across Ireland it is believed that up to 500 tonnes ends up dumped on the streets. Revolymer®’s technology can help solve a very costly and challenging problem and the consumer can help the environment without sacrificing quality.

In addition, to these environmental and convenience benefits, Rev7™ offers consumers a gum with and excellent taste and long lasting flavour. Currently available in peppermint and spearmint flavours and the company plans on expanding the portfolio in the coming year.

Roger Pettman, CEO of Revolymer® said: “With Rev7™ already in over 4,000 stores in the US we are really excited that the range is approved for sale in Europe and we have signed a deal with Topaz to launch the product in Ireland. With over 114 forecourts stocking our gum, this is a significant deal that will put our product in front of thousands of consumers and we hope that soon Rev7™ will be on sale across Europe.” Paul Candon, Marketing and Corporate Services Director of Topaz added: “We are pleased and excited to have added such an innovative product as Rev7™ gum to our offering. We believe that the gum’s longer lasting chew, coupled with the host of environmental benefits, means it will rapidly become a favoured choice with our customers.”

To help grow their business in the UK, Revolymer® has also brought on board the services of leading FMCG distributor and brokerage partner, Worldwide Brands Ltd. Martin Wathes, MD of Worldwide Brands ltd commented on their appointment that: “Worldwide Brands is extremely excited to be working with Rev7™ gum and see a huge potential for the brand.

As someone who regularly chews gum, I was really impressed with the chew and flavour of Rev7™, particularly on long journeys. Furthermore, with its strong environmental credentials and the fact that chewing gum litter is costing the UK government alone over £150 million per year, I can see huge potential for it to become a major player in the European gum market.”

For more information on Revolymer® and Rev7™ please visit: http://www.revolymer.com/removable_gum

Notes to Editors:

1. In testing Revolymer® found that its confectionery gum removes readily from a range of surfaces (including paved sidewalks, carpets, textiles, transport fabrics and clothing materials), and

disintegrates into a fine powder within 6 months using mild agitation in water. See www.revolymer.com for more details.

2. Revolymer® is a rapidly growing technology development company which has developed a unique portfolio of products and formulations for the FMCG industry. Using commercially available and

inexpensive polymers, Revolymer® applies its innovative proprietary approach to formulate novel polymers to revolutionise consumer products. Current applications for the Company’s technology are

in the Confectionery Chewing Gum, Medicated Chewing Gum, Household Products, Personal Care and Coatings & Adhesives sectors of the FMCG industry

For more information please contact Callum Laidlaw at Direct Impact on +44 (0)20 7300 6136 or

callum.laidlaw@directimpact.com

Xeros

Technology Strategy Board awards prestigious grant to Xeros

Xeros has been awarded a £250,000 grant for research and development by the Technology Strategy Board to accelerate the development of a domestic laundry machine, which will fully exploit Xeros’ environmentally friendly technology. The grant, the highest that can be awarded through the Technology Strategy Board’s Smart scheme, will be match funded by shareholder funds following a successful private equity funding round in 2011.

Xeros has established a process that delivers superior cleaning performance yet uses significantly less water, energy and detergent than conventional washing systems. The process uses small nylon polymer beads to ‘attract’ stains. Within the Xeros washing system, the gentle flow of the beads acts just like water. They tumble with the washload and transport stains off garments to be locked into the nylon’s molecular structure.

Building on its proven success in the commercial laundry market, Xeros will use the grant to design a washing system of comparable size, appearance and cost to conventional front loading machines that are used in millions of homes across the country. When compared to these machines, independent analysis1estimates that a Xeros domestic system would slash energy use by half and reduce water consumption by up to 80 per cent. It would also cut CO2 emissions per wash by 25 per

cent.

Domestic washing machines consume approximately 50 litres of water per wash. On average, washer/dryer systems account for 13 per cent of household energy use. If all UK households were fitted with machines powered by Xeros technology, the potential savings to UK consumers would total more than £2 billion per annum. It would also represent a net reduction of 4.2 million tonnes of CO2 per annum, the equivalent of taking 1.4 million cars off UK roads.

The domestic Xeros washing machine will be approximately one fifth of the size of the commercial technology that continues to be used by Jeeves of Belgravia and Watford Launderers & Cleaners as part of a long term trial.

Bill Westwater, Chief Executive of Xeros, said: “We are delighted that the Technology Strategy Board has awarded a significant grant to Xeros. Together with our own shareholder funding it will enable Xeros to accelerate our plans for the domestic market place. This has long been part of our business plan. If the application of our technology in this market matches the proven viability of our large size machines in the commercial laundry, we are one step closer to our ultimate goal, namely to convert

the world of aqueous washing to Xeros bead cleaning.”

Stephen Browning, Head of the Smart programme at the Technology Strategy Board, said: “The Smart scheme is designed to support research and development by SMEs that has the potential to offer economic growth and lead to the introduction of successful new products and processes. We are therefore very pleased to support Xeros through this grant as it will enable them to make the investment in staff, technology and materials needed to accelerate the development of their innovative product.”

Eykona

Sunday Telegraph: 3D to America

A medical technology business spun out of the University of Oxford is this month heading to America with its 3D imaging products that enables doctors to accurately measure whether wounds are healing.

Eykona, which spun out of the university in 2007, has opened an office in North Carolina as it aims to break the US market with its handheld camera that allows clinicians to take pictures of a wound, such as a bedsore or a diabetic ulcer, and measure how it is healing by turning it into a 3D image…..