Arvia

The next step for radioactive organic waste treatment at Sellafield

A collaborative Arvia™ and National Nuclear Laboratory project to treat oils and solvents contaminated with high levels of alpha radiation is funded by the government-backed Technology Strategy Board.

Arvia and the UK’s National Nuclear Laboratory (NNL) have been granted funding to deliver a collaborative project by the Technology Strategy Board, the UK’s innovation agency, in an initiative that is supported by the Nuclear Decommissioning Authority. The project aim is to use Arvia’s proven technology to destroy oils and solvents which are contaminated with high levels of alpha radiation, currently located at the Sellafield site……

Microsaic Systems

Parkwalk closes investment in Microsaic Systems plc for the UK Tech Fund IV & ZeroND Fund

Microsaic is the first, and only company to have successfully miniaturised mass spectrometry through the development of its patented chip-based technologies. These technologies are based on Micro-Electrical-Mechanical Systems (MEMS) developed by the Optical and Semiconductor Devices Group at Imperial College.

The Company’s first product, the Microsaic 3500 MiD®, was launched in January 2011 and is the world’s smallest MS system.

Horizon Discovery

Parkwalk closes investment in Horizon Discovery for the University of Cambridge Enterprise Fund I

Horizon’s basic science and translational research knowledge deployed in combination with best-in-class translational genomics platforms, products and services provides meaningful solutions to the challenges of translational researchers.

Horizon aspires to provide solutions that unlock the promise of the human genome project for the benefit of scientific researchers, patients and society; provide powerful research tools to advance the development of personalized medicines; provide molecular reference standards and support better healthcare outcomes for patients.

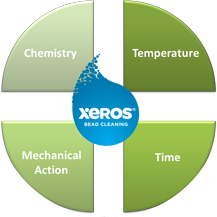

Xeros

Joins forces with BASF to develop next generation bead cleaning technology

Future of commercial laundry to be showcased at The Clean Show 2013 in New Orleans

Manchester, New Hampshire (May 13, 2013) – Xeros Ltd., the UK-based innovator of an ultra low water cleaning system, announced today that it has partnered with the chemical company BASF to jointly develop polymer beads based on engineering plastics that will increase the cleaning power in laundry applications. This long-term agreement reflects the mutual commitment of the two companies to maximize the commercialisation of the Xeros cleaning system and protect the environment by conserving water and energy.

“This is an exciting time for Xeros,” said Bill Westwater, Chief Executive Officer of Xeros Ltd. “Our growth strategy is on target, building on the momentum of our international expansion into the United States via our subsidiary Xeros Inc.. This long-term partnership with BASF solidifies the future of our revolutionary cleaning system, bringing us together with one of the world’s most powerful companies in terms of chemical engineering, product performance and social responsibility.”

With installations underway in three distinct segments of the commercial laundry industry, Xeros will formally launch its new system to the worldwide commercial laundry market at the June 2013 Clean Show in New Orleans. Xeros will showcase its innovative bead-cleaning technology and highlight the future of the commercial and residential laundry industry at the event, which will be held June 20-22 at the New Orleans Morial Convention Center. Here, guests will have an opportunity to see the Xeros technology in action and meet the creative minds behind it.

The Xeros cleaning system comprises a special washing machine designed to release the beads into the drum for cleaning, and which then removes the beads from the clothes once the cleaning is complete. With at least 70% less water, up to 50% less energy and approximately 50% less detergent, the Xeros system delivers superior cleaning results compared to conventional washing. The beads have a lifespan of hundreds of washes before being collected and recycled.

“On the one side, as globally active chemical company we can support Xeros through our global network and the worldwide availability of our materials. On the other side we can make use of our strong research and development base which can provide tailormade plastics with specific combinations of properties,” explains Matthias Dietrich from BASF’s business unit Engineering Plastics Europe.

Through the use of polymer bead technology, the Xeros cleaning process has shown to be more effective than traditional “soap and water” methods. By combining the beads’ molecular structure with a proprietary detergent solution, the result is a superior cleaning medium that beats even water. The dirt from soiled items is attracted and absorbed by the beads, producing cleaner results than aqueous washing methods.

The Xeros system first entered the U.S. market at Manchester, NH’s Sterling Linen Services, a high-quality linen processing and rental service for area hotels, hospitals and restaurants. Xeros quickly followed by installing its next machine at the Hyatt Regency Reston in Reston, VA, which began using Xeros’ proprietary bead cleaning solution for its guestrooms and restaurants. Then, in February 2013, the company extended its reach into the North American dry cleaning channel with the installment of a third unit at Crest Cleaners in Clifton, Virginia.

Clean Air Power

Announces significant US Grant Funding

Clean Air Power (AIM: CAP), the developer and global leader in dual-fuel engine management software for heavy duty vehicles, is pleased to announce it has executed an agreement to receive a grant to support its development of a Genesis EDGE Dual-Fuel™ product for the important US market (the “Program”). The commencement of this Program was originally announced on 29 August 2012 and will deliver a US Genesis product certified to US2010 emissions levels and enable the Company to access the growing demand in the US for natural gas vehicles…..

OxfordPV

Nature – Mesoporous TiO2 single crystals delivering enhanced mobility and performance

Tracsis

Recommended Cash Offer for Sky High plc

RECOMMENDED CASH OFFER

FOR THE ENTIRE ISSUED SHARE CAPITAL OF SKY HIGH PLC

(other than those shares acquired by Tracsis under the Management Agreement and the Prowse Trust Agreement)

And

NOTICE OF GENERAL MEETING OF SKY HIGH PLC

The boards of Sky High and Tracsis have today agreed the terms of a recommended cash offer to be made by Tracsis for the entire issued ordinary share capital of Sky High, excluding the Management Roll Over Shares and the Prowse Trust Shares (as defined below), at 15.25p per Sky High Share (the “Offer”).

The Offer values Sky High’s entire issued ordinary share capital (including the Management Roll Over Shares and the Prowse Trust Shares) at approximately £3.28 million and an Offer Document has today been dispatched to all Sky High shareholders (the “Offer Document”), setting out the terms and conditions of the Offer.

Summary

· The Offer represents a premium of approximately 69.44% to the Closing Price per Offer Share of 9p on 25 March 2013 (being the last Business Day prior to the date of the Announcement);

· The Offer represents a premium of approximately 76.91% to the weighted average Closing Price per Offer Share of 8.6p for the six months ended 25 March 2013 (being the last Business Day prior to the date of the Announcement).

· Mark Mattison, Grant Wilson and Martin Prowse, directors of Sky High, are acquiring 308,563 shares in Tracsis pursuant to the terms of a Management Agreement (the details of which are set out below) and in respect of which the Sky High Shareholders are being asked to vote at the Sky High General Meeting, and Alex Johnson, who is not a Sky High Shareholder, is a party to certain Management Arrangements, they have not taken part in consideration of the Offer as directors of Sky High.

· The Offer is conditional, amongst other things, on:

o valid acceptances being received in respect of not less than 90% of the Offer Shares (or such lower percentage as Tracsis may decide) provided that this condition will not be satisfied unless Tracsis shall have acquired or agreed to acquire, whether pursuant to the Offer or otherwise, Sky High Shares carrying in aggregate more than 50% of the voting rights normally exercisable at general meetings of Sky High; and

o the Independent Shareholders passing the Ordinary Resolution to approve the Management Arrangements at the Sky High General Meeting.

· The Independent Directors, having been so advised by SPARK Advisory Partners Limited, consider the terms of the Offer to be fair and reasonable and unanimously recommend that:

o all Sky High Shareholders accept the Offer; and

o all Independent Shareholders vote in favour of the Ordinary Resolution to approve the Management Arrangements to be proposed at the Sky High General Meeting to be held at 2.00pm. on 15 April 2013.

· The Independent Directors have irrevocably undertaken to:

o accept (or procure the acceptance of) the Offer in respect of an aggregate total of 10,819,607 Sky High Shares representing, in aggregate, approximately 60.70 per cent. of the Offer Shares and 50.28 per cent. of all of the Sky High Shares; and:

o to vote (or procure the vote), in favour of the Ordinary Resolution, in respect of an aggregate of 10,819,607 Eligible Voting Shares, representing, in aggregate, approximately 67.16 per cent of the Eligible Voting Shares.

Commenting on the Offer, John McArthur, CEO of Tracsis said:

“The combination of Tracsis and Sky High is an exciting opportunity as it adds considerable breadth, depth and scale to our existing offering. The acquisition not only widens the number of fields the Group services within the transportation industry, but also importantly adds a new territory to its current geographic footprint.

“As the largest provider of traffic analysis and surveys within the UK, Sky High has significant stature in the market, a formidable reputation, and robust systems to meet the data and analysis needs of its enviable client list. Given our own success within the rail industry, which already includes survey and analysis work, we see great cross-selling opportunities of both services and technology to this new market, whilst expanding our reach overseas given the considerable presence Sky High has in Australia.

“We believe that this acquisition, whilst being immediately earnings enhancing, will also drive growth for the combined Group and in turn provide further value to our shareholders.”

Commenting on the Offer, Mark Mattison, CEO of Sky High said:

“We welcome the opportunity to join Tracsis and see that, as part of larger transport technology Group, it will bring both immediate and longer term benefits to our clients and staff. The acquisition will ensure that Sky High is well placed to both grow our client base and continue to provide our current clients with a high quality and cost efficient service. In addition, joining Tracsis not only grants us access to new technical capabilities that can be utilised within the highways sector, but also allows the business to re-focus management’s time and efforts on delivering growth and new product initiatives.”

For more information please contact:

| John McArthur, Tracsis plc | Tel: 0845 125 9162 |

| Mark Mattison, Sky High plc | Tel: 01937 833 933 |

| WH Ireland Limited (financial adviser to Tracsis plc)Katy Mitchell

Dan Bate

|

Tel: 0161 832 2174 |

| SPARK Advisory Partners Limited (financial adviser to Sky High plc)Sean Wyndham-Quin

Neil Baldwin |

Tel: 0113 370 8975 |

Tangentix

Parkwalk closes investment in Tangentix for the UK Tech Fund III & ZeroND Fund

Tangentix is dedicated to providing the best possible game delivery experience, using proprietary and patented technologies to compress game assets so a typical AAA title is reduced to around 1/3rd of its existing size- making downloads comfortable for nearly all internet users.

This approach means that downloads can reach a wider audience, gamers can buy more games, and publishers benefit from deeper links to the customer and stronger margins.

Xeros

Parkwalk closes further investment in Xeros on successful £10m raise

Xeros’ mission is to convert the $100bn global laundry industry to Xeros polymer bead cleaning.

Up to 80% less water, 50% less energy and 50% less detergent is used in the Xeros system versus conventional washing.

If all UK households were fitted with machines powered by Xeros technology, the potential annual savings to UK consumers would be £2bn and would reduce CO2 emissions by 4.2m tonnes – the equivalent of taking 1.4m cars off UK roads.

The technology was launched commercially in late 2012 with successful affirmation sites in London & the US.

Tracsis

Interim results – Strong progress across all segments

Tracsis plc (AIM: TRCS), is pleased to announce its interim results for the six months ended 31 January 2013.

Financial Highlights:

· Revenues increased 29% to £4.7m (H1 2012: £3.7m)

· Adjusted EBITDA increased 49% to £1.9m (H1 2012: £1.3m)

· Profit before tax increased 50% to £1.7m (H1 2012: £1.1m)

· Cash balances up by £0.9m to £8.5m (H1 2012: £6.0m, FY 2012 £7.6m)

· Interim dividend proposed of 0.3p per share (H1 2012: 0.2p per share)

Operational Highlights:

· Further sales of TRACS optimisation software achieved

· Completion, successful launch and first contract with a major UK operator for new rail freight product – FreightTRACS

· Further international progress with sale of COMPASS reporting software in New Zealand market

· Extensive franchise bid support work for multiple transport owning Groups

· Strong demand for passenger counting & analytics services

· Continued demand for the MPEC condition monitoring technology

· Excellent client retention and account management across the Group

John McArthur, Chief Executive Officer, commented:

“I am pleased to report further substantial growth in the period with all areas of the Group performing ahead of the same time last year. In addition to winning several new contracts both in the UK and abroad, we have developed and launched a new software offering for the rail freight sector which has been sold to our first customer marking our entry into a new market.

“The Group remains well positioned for further growth and continues to benefit from an excellent financial position, a diverse product offering to blue chip clients, and a healthy pipeline of acquisition prospects.”

Mode DX

Bloomberg: DIY tests enable cancer diagnosis in bathroom

Mode Diagnostics Ltd. wants to bring the medical laboratory into your bathroom — with a mobile phone-size device that can detect signs of cancer right before your eyes.

The do-it-yourself test market, estimated at $2 billion to $3 billion globally, is expanding 20 percent a year as new checks for colon and prostate cancer, HIV, chlamydia, stomach ulcer, sperm count and drug abuse take their place on pharmacy shelves alongside standards such as blood-sugar monitors for diabetics and pregnancy tests, according to Alan Hirzel, a London-based partner at consulting company Bain & Co……

Lime Micro

Signs distribution deal with Richardson RFPD

Launch distribution of configurable multi-band, multi-standard transceiver with integrated DACs and ADCs

Richardson RFPD, Inc. recently announced it has completed an agreement to distribute product from Lime Microsystems (“Lime”), an England-based manufacturer that specializes in field programmable RF transceivers (FPRFs) for the next generation of wireless broadband systems. Under the agreement, Richardson RFPD will distribute Lime’s LMS6002D multi-band, multi-standard transceiver worldwide, with the exceptions of Korea and Taiwan…..

Tracsis

Enters the rail freight planning market

Financial Times – Backing UK business – tax-efficiently

The finance “dragons” of the real world tend to be managers of Venture Capital Trusts (VCT) and Enterprise Investment Schemes (EIS)….. read more here (subscription required)

Sphere Fluidics

Parkwalk closes Sphere Fluidics investment for the University of Cambridge Enterprise Fund I

Sphere Fluidics has developed unique products for use in single cell analysis and characterisation and provides collaborative R&D services.

A novel technology platform (called Cyto-MineTM) enables ultra-high throughput analysis of single cells and generation of their genetic, transcriptomic and proteomic profiles in miniaturised (pl to nl) volumes called picodroplets.