Revolymer

Revolymer CEO to leave at end of January

LONDON (Alliance News) – Polymer technology company Revolymer plc on Monday said Chief Executive Roger Pettman will leave at the end of the month as he seeks to launch other new ventures.

“Dr Pettman’s particular expertise within Revolymer has been in the establishment of the business, having identified the business model of using novel polymers to improve the performance of existing consumer products. He is now looking forward to working on establishing other new ventures” the company said in a statement.

Revolymer Chief Financial Officer and Company Secretary Rob Cridland will become acting CEO while the company seeks a permanent replacement for Pettman.

Xeros

Sunday Times: Waterless washing machine maker joins float cycle

Fuel 3D

Parkwalk closes syndicate investment into Fuel 3D, a new 3D scanner company out of Oxford.

Fuel3D is developed by an expert team of hardware and software engineers and scientists. Originally developed for the medical imaging sector, Fuel3D’s technology is being adapted for the broader 3D market, with the goal of bringing the benefits of point-and-shoot 3D imaging to consumers and professionals alike. Originally developed by Professor Ron Daniel, Lecturer in Engineering Science at Oxford University, Fuel3D is today led by Stuart Mead, CEO, a veteran of several successful global technology ventures.

The Fuel3D handheld scanner is a point-and-shoot 3D imaging system that captures extremely high resolution mesh and color information of objects. Fuel3D is the world’s first 3D scanner to combine pre-calibrated stereo cameras with photometric imaging to capture and process files in seconds.

YASA

Parkwalk leads successful £5m funding round into YASA Motors.

The company manufactures a highly differentiated advanced axial flux motor and generator based on its proprietary Yokeless And Segmented Armature (YASA™) technology.

For a given power & torque requirement, YASA can deliver a significantly smaller and lighter electric motor than any other competing technology. Furthermore, the technology is inherently lower cost than competitor motors due to the exceptionally high utilisation of magnetic material.

The high performance YASA motors and generators are suitable for range of markets and applications, and excel in the toughest environments where weight and space are critical for the end-user .

Friday Thoughts

New ‘all time highs’ – what’s the significance….?

We have heard it again this week in the US regarding the S&P 500, and it may not be long before we hear it here in the UK regarding the FTSE 100.

Financials and Tech stocks have been making gains following positive economic reports and strong earnings.

The term itself seems to automatically triggers some sort of hysteria, suggesting that things are due to tip the other way any second. We inately believe that over short periods of time that random occurences are meant to balance out. That 10 straight coin flips on heads should virtually assure that a tail will be next, despite the fact that nothing that came before it matters.

This is a cognitive defect we have, known as the Gambler’s Fallacy.

The American gangster, Bugsy Siegel, in 1945 figured this out before it even had a name and so he showed up in the middle of the Nevada desert to capitalise on it.

An entire city sprouted up virtually overnight, and Vegas lives to this day because of that exact reason.

If only the world didn’t work this way.

Anytime we saw something unprecedented take place, such as new stock price highs, we’d simply bet the other way.

Of course in reality, doing this would wipe us out completely and permanently.

There is more meaning to an all time high than meets the eye.

It means that people paid a price that no one before them was willing to pay.

It means no one has a loss in the stock.

It means those waiting for a pullback to get in are now ripping their hair out.

It means it is now the new favourite stock, a winner, that people will not part with easily.

It means every single analyst downgrade or estimate revision has been instantly invalidated, and was a waste of ink.

Finally however, it means that the stock must now be on it’s best behaviour from here on.

There will be more margined up positions than ever before.

Starting off the movie theme of todays note, and the advice received by Bud Fox – ‘kid, you’re on a roll, enjoy it while it lasts, cos it never does….’

But this does not mean the coin is about to flip tails.

And so while 100,000 yrs of evolutionary programming may lead us to believe that a new all time high is a precarious perch, it isnt ever quite that simple.

Just don’t be scared of it….

So, what to do if you are seeing these headlines….??

We all know about last years market performances, however, less than 50% of those in the UK (52% in US) are personally invested in the stock market.

Many investors, still reeling/scarred from the financial crisis chose to stay on the sidelines and missed it.

Inevitably, these folk are now kicking themselves, but are equally worried about a correction and stepping in at the top (as above, gambler’s fallacy etc).

After such a rally, and in this situation it is likely that investors will make one of 2 mistakes.

1. Extrapolate from last year’s returns and take on too much risk.

2. Look at the recent run and decide to wait til the market ‘pulls back’.

Really, what investors should do is something in between.

1. Develop an investment plan that meets their timeline, goals, objectives and risk tolerance, and rebalance it continously……leaving a portion of cash for ‘opportunism’

2. Accept that if you want to grow your wealth it will have to involve some amount of risk exposure….there is no risk-free way to do this. That was true last year, it is true today, and will be true 100 yrs from now….

S&P 500 – 10 yr

Currencies

2014 – year of the dollar?

Blackrock published a note this week on the US dollar over the coming 12 months or so.

There were 3 key poing which they made pointing to an expected strong performance.

1. Improving US economy – Significantly more than that of other developed countries. US 2.5-2.75%, less than 2% Japan, and 1% for Europe.

2. Fed policy – The Fed will be pulling back when many other central banks will need to maintain a loose monetary policy. There is no way Europe, Japan, China central banks will be tightening. In contrast, by year end the Fed is expected to have exited its QE programme. The Bank of England, and sterling, is the only possible exception.

3. Valuation – Many of the key developed market currencies still look expensive relative to the dollar, based on purchasing power. Swiss Franc and Aussie dollar look to be 25% overvalued v Dollar.

The most significant point, and likely to have most effect is Fed policy.

And since FX is untimately a relative value game, you have to consider how interest rates and central bank policy will come into play.

Dollar X-rate 10 yr

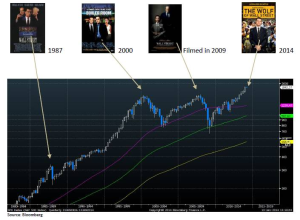

The ‘Hollywood Top’

How’s this for an indicator??

Every time a film comes out about ‘Wall St’ the market crashes??

Unfortunately not quite a full-proof stratgey…..!

Arbitrage came out in 2012, and Margin Call in 2011…..wasn’t quite the top then…….

And, of course, the greatest of all trading movies – Trading Places. This doesn’t appear as it came out in 1983, the very start of the greatest bull run of all time….

Other bits of interest…..

Microsaic Systems

Microsaic Systems is pleased to announce the launch of the MiDas™ interface module which allows simple connectivity of its miniaturised mass detector, the 4000 MiD®, for on line and off line analysis. The MiDas compact integrated interface unit offers automated sampling, dilution and injection for direct mass spectrometry (MS) analysis at the lab bench or fume hood, representing a unique integrated solution for delivering main-stream MS analysis to the lab bench.

Colin Jump, CEO Microsaic Systems commented, “The MiDas module adds to the flexibility of our successful 4000 MiD by allowing the simple deployment of mass detection in a large variety of realtime applications. The MiDas interface unit integrates with the 4000 MiD, offering a compact unit which gives the bench chemist the benefits of analytical chemistry where it’s needed.”

Applications range from analysing the compositions of unknown liquids in a beaker to reaction monitoring from a batch, flow reactor to semi-prep LC. MiDas allows sample analysis by direct injection and reaction mixtures from both flow and batch reactors. Masscape software on the 4000 MiD controls the dilution and port in the MiDas for flow and direct injection monitoring. The separate sampling pumps used for batch reaction monitoring are also fully controlled by the software. Automated sample sequences include flushing to ensure no carry-over. Easy-to-use software allows data analysis in real-time. Remote desktop control via LAN is available for remote control of both the MiD and MiDas.

Microsaic Systems is the first and only company to have commercialised mass spectrometry technology on a chip based on MEMS technology. The Microsaic 4000 MiD’s low operating cost and small footprint make the instrument deployable in a wide range of applications where mass spectrometry has not been able to reach. The 4000 MiD fits comfortably into a standard lab fume hood, opening up further opportunities in the field of on-line reaction monitoring. Users are able to increase the use of mass spectrometry in the laboratory, while benefiting from significant cost savings, owing to fewer necessary structural components such as gas generators and air conditioning. There are also sizeable savings with the use of ‘Plug and Play’ components which enable users to maintain the system themselves, resulting in less downtime and greater flexibility within the laboratory.

About Microsaic Systems plc

Microsaic Systems plc is a high technology company developing and marketing next generation mass spectrometry (MS) instruments for the analysis of gaseous, liquid and solid samples. Microsaic has successfully miniaturised mass spectrometry by integrating the key MS components onto patented chip technologies called ionchip®, spraychip® and vac-chip™. Microsaic’s MS products retain the speed and sensitivity of larger, conventional MS systems but are substantially smaller, lighter, consume less energy and have lower running costs. The Microsaic 4000 MiD is the world’s smallest MS system.

Microsaic Systems plc was established in 2001 to develop miniaturised MS instruments based on Micro- Electrical-Mechanical Systems (MEMS) originating at the highly regarded Optical and Semiconductor Devices Group at Imperial College London. Microsaic has subsequently established a large portfolio of 93 patents, of which 58 are granted, and six registered trademarks. For more information, please visitwww.microsaic.com.

Tracsis

Tracsis wins significant order – Tracsis, a leading provider of software and technology led products and services for the transportation industry, is pleased to announce that it has received a significant order for its Remote Condition Monitoring equipment.

The initial order, which has been placed through the five year Framework Agreement announced on the 21st October 2013, comes from an existing UK client and has a value of £2.2m. It will be fulfilled within the current financial year as per an agreed delivery schedule with the customer.

An order of this magnitude provides the Group with additional confidence in meeting current market expectations.

John McArthur, Chief Executive Officer commented:

“We are delighted to have won this further major order, which is testament to the quality of the technology solutions we provide and our excellent working relations within the rail industry. Given the magnitude of this order, we believe Tracsis is well placed to win further contracts of this nature both within the UK and overseas.”

Enquiries:

| John McArthur, Tracsis plc | Tel: 0845 125 9162 |

| Katy Mitchell, WH Ireland Limited | Tel: 0113 394 6618 |

| Rebecca Sanders Hewett/Jenny Bahr, Redleaf Polhill | Tel: 0207 566 6720Tracsis@redleafpolhill.com |

Notes to editors:

§ The Group specialises in solving a variety of data capture, reporting and resource optimisation problems along with the provision of a range of associated professional services.

§ Tracsis’ products and services are used to increase efficiency, reduce cost and improve the operational performance and decision making capabilities for clients and customers.

§ The Company offers the following services:

– Data Capture: Collation and analytical services within traffic and pedestrian rich environments.

– Software: Industry strength resource optimisation software that covers a variety of asset classes.

– Remote Condition Monitoring: Technology and reporting for critical infrastructure assets in real time, to identify problems and aid with preventative maintenance.

– Professional Services: Consulting and related professional services across the operational and strategic planning horizon.

§ Tracsis has a blue chip client base which includes the majority of UK transport operators such as Arriva, First, Stagecoach, Go-Ahead, National Express and Virgin. The business also works extensively with Network Rail, the Department of Transport, multiple local authorities, and a variety of large engineering/infrastructure companies.

§ Tracsis has offices in the UK and Australia which service projects in Europe and Australasia.

§ The business drives growth both organically and through acquisition and has made five acquisitions since 2008.

§ For more information visit www.tracsis.com

Horizon Discovery

Jan 7 (Reuters) – Horizon Discovery: * Horizon discovery and Astrazeneca have entered into a research, collaboration and license agreement * Agreement to explore a range of oncology-relevant genotypes * Will receive an undisclosed upfront payment * Eligible for subsequent payments of up to $88 mln in milestones if compounds are developed by Astrazeneca

DefiniGEN

Parkwalk closes DefiniGEN investment for the University of Cambridge Enterprise Fund II

DefiniGEN provides human liver cells for preclinical drug development and disease modelling applications using human Induced Pluripotent Stem Cell hIPSC technology.

The Company provides human cells to the drug discovery sector for use in lead optimization and toxicity programmes. The Company’s proprietary production platform OptiDIFF robustly generates human cell types including liver hepatocytes using hIPSC human Induced Pluripotent Stem Cell technology.

Tracsis

North America pilot – Tracsis plc, a leading provider of software and technology led products and services for the transportation industry is pleased to announce that it has been awarded a feasibility pilot project with a major North American Class 1 Railroad company for potential adoption of its remote condition monitoring technology and associated software.

The project will cover 5 sites within the United States, should conclude within 6 months, and is being delivered in collaboration with a US based technology partner following a successful tendering process. The value of this project will remain undisclosed due to commercial sensitivities.

This award is a significant step forward in the next phase of the Company’s overseas growth strategy although Tracsis is keen to stress that at this point in time the feasibility project has no guarantee of future sales.

Enquiries:

| John McArthur, Tracsis plc | Tel: 0845 125 9162 |

| Katy Mitchell, WH Ireland Limited | Tel: 0113 394 6618 |

| Rebecca Sanders Hewett/Jenny Bahr, Redleaf Polhill | Tel: 0207 566 6720Tracsis@redleafpolhill.com |

Notes to editors:

§ The Group specialises in solving a variety of data capture, reporting and resource optimisation problems along with the provision of a range of associated professional services.

§ Tracsis’ products and services are used to increase efficiency, reduce cost and improve the operational performance and decision making capabilities for clients and customers.

§ The Company offers the following services:

– Data Capture: Collation and analytical services within traffic and pedestrian rich environments.

– Software: Industry strength resource optimisation software that covers a variety of asset classes.

– Remote Condition Monitoring: Technology and reporting for critical infrastructure assets in real time, to identify problems and aid with preventative maintenance.

– Professional Services: Consulting and related professional services across the operational and strategic planning horizon.

§ Tracsis has a blue chip client base which includes the majority of UK transport operators such as Arriva, First, Stagecoach, Go-Ahead, National Express and Virgin. The business also works extensively with Network Rail, the Department of Transport, multiple local authorities, and a variety of large engineering/infrastructure companies.

§ Tracsis has offices in the UK and Australia which service projects in Europe and Australasia.

§ The business drives growth both organically and through acquisition and has made five acquisitions since 2008.

§ Tracsis listed on AIM in 2007 under ticker TRCS.

§ For more information visit www.tracsis.com

Horizon Discovery

Horizon Discovery named in the Deloitte Tech Fast 50 2013

Fund Managers Comments

UK Technology Companies Financings Background

There has been a strong UK IPO market in 2013 according to Dealogic who state that 44 companies have gone through a successful IPO on the London Exchange (Full List and AIM) in the first nine months of 2013 raising £6.6bn, three times the amount raised in 2012. This is the highest amount since 2007.

The London AIM market has been exceptionally busy. In Q3 2013 PWC report that there were 20 IPOs on AIM raising £470m compared to the same period in 2012 when there were 13 IPOs raising £200m.

While many of these IPOs were sales from private equity or funds raising money, technology companies have begun to become part of the picture.

University Spin-out IPOs

Perhaps the most interesting IPO from the standpoint of Parkwalk’s investment strategy has been that of the Durham Spin-out Kromek. It started life in 2003, well before Parkwalk existed, and as such we are not an investor. However its successful IPO in October bodes well for many of the companies in our portfolio, particularly Symetrica whose business overlaps some of Kromek’s activities. Kromek successfully raised £15m at a pre-money valuation of £40m (51.0p a share) and is currently trading around 65.0p a share.

It has been announced in the press that Imperial Innovations’ largest company (around 24% of its total portfolio valuation), Circassia will seek to IPO in the coming months at a valuation of around £400m. If this were successful it would do a significant amount to underpin, and possibly raise, valuations in the sector.

Applied Graphene Materials (in which IP Group holds a 25% stake) announced in October it was seeking to IPO and raise around £10m. It is another spin-out from Durham University.

Funds Specialising in University spin-outs

Cambridge University announced the successful closing of Cambridge Innovation Capital, a £50m Fund, which will invest in growth funding rounds in Cambridge University spin-outs and other Cambridge based technology companies. As a result it will likely overlap some of its investments with the Parkwalk managed University of Cambridge Enterprise Funds.

Neil Woodford, the uber fund manager at Invesco, announced he was leaving the firm in April 2014 to set up his own Fund Management group. Under his guidance Invesco has been a significant investor in this space. Invesco own substantial stakes in IP Group and Imperial Innovations as well as a number of direct stakes in private and public companies in this space. It is speculated that his new management firm will follow a similar investment strategy.

Implications for Parkwalk’s Investment strategy

The strength of the public markets is excellent news for our portfolio of investments as it should increase valuations in both the public and private markets (as private tends to ‘feed off’ public). It is also likely to mean more exits in the space as a whole as IPOs become an option and companies looking to acquire technology in trade deals will also be able to use their publically quoted paper.

In the short-term there may be an opportunity arising as a result of the changes at Invesco which could lead to private valuations plateauing if Invesco were to reduce its exposure in this area until they likely rise once it becomes clear what investment strategy Neil Woodford’s new vehicle will adopt.

We have a number of companies in our portfolio contemplating an IPO in the next 18 months.

Current Parkwalk opportunities

We continue to see interesting investment opportunities throughout the year and this is increasingly being matched by demand from our client base for year-round EIS investments.

Our evergreen Opportunities Fund and our non-domiciled investor ZeroND Fund cater for this and allow our investors to deploy capital, and claim reliefs, faster. In the near term, we have two or three investments we will look to make before the end of the current tax year and we ask our investors to be in touch if they would like to find out more.

Arvia

Parkwalk is pleased to announce that they have led a £2.8m follow on financing into Arvia Technologies ltd.

Arvia represents a dramatic change from the traditional methods for treating organic liquid waste.

Arvia has established a process for the destruction of radioactive liquid organic wastes produced in the course of nuclear power generation, decommissioning and at stages within the nuclear fuel cycle. The patented technology has been specifically developed for the demands of the nuclear industry. Treatment of the liquid organic waste stream takes place in a single unit with no moving parts, is chemical free and the process can destroy a wide range of radioactive organic waste streams.

OxfordPV

OxfordPV: CEO to participate in UK solar trade mission to Saudi Arabia

Kevin Arthur, Co-Founder and CEO of Oxford Photovoltaics (Oxford PV), is to join Greg Barker, Minister of State for the Department of Energy & Climate Change (DECC) in a forthcoming solar trade mission to Riyadh, Saudi Arabia from the 11th to 12th of November 2013.

A huge growth market for solar power, Saudi Arabia aims to power its energy-intensive economy largely through renewable sources by the middle of this century, freeing up vast quantities of oil for export.

The UK trade mission will include a programme put together by the Department for Energy & Climate Change, UK Trade and Investment and the British Embassy to explore unparalleled opportunities for UK firms to access the Saudi market, estimated to reach some $100 billion.

Following a separate invitation from the DECC, Kevin Arthur has also recently joined the UK PV Strategy Group Innovation Task Force, to provide first-hand knowledge and experience of solar technology and assist in identifying new innovations that will stimulate deployment.

Oxford PV has exclusively licensed and is developing a photovoltaic technology that has the potential to deliver low cost, efficient solar cells that can be readily incorporated into glass building facades.

Kevin Arthur said:

“For Oxford PV, this UK trade mission will give us the chance to make high level contacts as we explore opportunities for future collaboration in adopting our technology into large scale buildings in Saudi Arabia. It will also allow us to assess what appetite exists for Saudi investors to join in with future funding rounds in our company.”

Rt Hon Greg Barker, Minister of State for Energy and Climate Change, said:

“This is a very exciting mission. The UK solar sector is a honeypot of innovation and potential, and with Saudi Arabia set to spend a staggering 100 billion dollars on solar, UK firms are natural partners for them, with a huge amount to offer, especially at the added value end of the market.”

OxfordPV

OxfordPV: named the winner of the Solar Award for Excellence: BIPV Innovation at the 2013 Solar UK Industry Awards.

The award was presented to Oxford PV Founder and Chief Executive Officer Kevin Arthur at the Solar UK Conference, held this year at the BRE Innovation Park in Watford on the 7th November 2013.

The Solar UK Awards recognise the success and development along the entire value chain of the industry from the research in the labs to the person who installs it, recognising the vital individuals and companies that enable a company to achieve success in a competitive market.

The award is the third such accolade Oxford PV has received in the last six months in recognition of its new photovoltaic technology, which has the potential to deliver low cost, efficient solar cells that can be readily incorporated into glass building facades.

In June, Oxford PV received the Innovation Award at British Renewable Energy Awards ceremony, and in July was the winner of the Best Early Stage Investment in a Disruptive Technology Business Award at the annual UK Business Angels Association Awards.

Kevin Arthur said: “This award is well-deserved recognition for our growing team at Begbroke Science Park in Oxford, all of whom have helped the company to make huge progress over the last 12 months in the development, testing and commercialisation of our technology.”

Omega Diagnostics

Omega Diagnostics: ‘majority’ of CD4 manufacturing variants eliminated