Dear ,

We are delighted to announce that the University of Oxford Isis Fund II, managed by Parkwalk, has invested in Mind Foundry, an Oxford Spin-out company with technology that uses advanced machine learning algorithms to help organisations solve problems by unlocking insights hidden deep within their big data.

We are in the midst of an information revolution, where advances in science and technology, as well as the day-to-day operation of successful organisations and businesses, are increasingly reliant on the analysis of data. Driving these advances is a deluge of data, which is outstripping the increase in computational power available to process it. Increasingly, data is machine generated and streamed continuously with no human intervention, whilst other data is created by individuals as they connect and engage within an expanding digital universe.

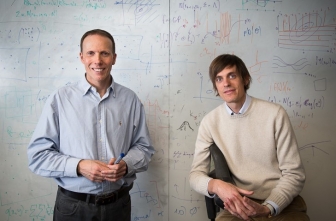

Mind Foundry is the result of collaboration between two prominent members of Oxford’s Machine Learning Group. The company intends to productise its extensive knowledge in the application of machine learning and advanced algorithmic modelling techniques to help solve some of the greatest challenges faced by organisations today as data becomes critical to ongoing performance and business success.

The Market Opportunity

Mind Foundry’s addressable markets represent some of the most commercially interesting and valuable for any software enterprise. The application of machine learning techniques to big data analytics and real-time Data-in-Motion will fundamentally change how organisations interact with data, develop insight and ultimately service their customers.

A recent report by Transparency Market Research (2015) forecasts that the global predictive analytics market will achieve a compound annual growth rate of 17.8%, reaching $6.5 billion (USD) by 2019, from $2.1bn in 2013.

Whilst the technology can be deployed within many vertical markets, the initial focus will be on three markets where the company has domain experience. These are:

Banking & Finance

- Large and mature sector (18% of total predictive analytics market)

- Understanding of current technology limitations and seeking next generation technology

- Operating in a technology “arms race“ and willing to invest in leading edge technology to maintain competitive advantage

Energy sector

- Generation, distribution, retail and energy trading

- Migration to the “smart grid” with reliance on predictive data

- Smart domestic metering increasing reads from 6m to 18bn per year, with associated data rich environment. Active acquisitions in the smart energy sector (e.g. Google’s acquisition of Nest for $3.2bn in 2014)

Industrial Internet of Things

- Physical machines augmented with digital intelligence and smart sensing technology

- Explosion in connected devices and smart sensors (IBM: 42% of all data will be machine generated by 2020)

- Industrial internet analytics will be transformational. GE, IBM, Rolls Royce, Google, Apple all investing

In all the above mentioned markets, huge amounts of highly dynamic data streams are generated and the need to extract valuable knowledge from this is high. There is requirement and appetite for intelligent data analytics across sectors.

Past and existing projects give Mind Foundry a long and high-quality warm target-list for their technology. Key players in all three markets have already shown interest in working with Mind Foundry once the product is market ready.

The Technology

The technology represents the commercialisation of 30 years of accumulated knowledge in the field of advanced data analytics, including projects awarded over £30m in the last 5 years alone. The technology has been successfully implemented in many commercial environments under a consultancy led model.

A set of core machine learning algorithms will be licensed to Mind Foundry. Through year 1 of incorporation, these algorithms will be developed into application software, which will be subject to copyright protection. Mind Foundry will work with high-impact clients to deliver value.

The Model

The approach is to incorporate advanced algorithms into an application software product and uniquely remove the technical obstacles to extracting value from data by automating a three-stage process, which takes clients from raw data to decision in milliseconds:

- Characterising and integrating diverse and unstructured data

- Surfacing the anomalies and insight that this combined data holds

- Recommending or automatically actioning the optimum outcome based on these anomalies and insight

This will allow Mind Foundry to change from a consultancy led business to an enterprise software business, where it is estimated 80% of revenues could be software generated with 20% derived from services. This in term will allow the company to scale.

The goal is to have a first viable product release within 12 months of funding, whilst supporting product development with the recruitment of commercial beta clients in our target markets.