|

| |

Parkwalk VI

The Parkwalk UK Tech Fund VI will be closing to new investors in the coming weeks. We have identified the first investments for the Fund and we expect the first to close early in the new tax year.

|

|

|

|

|

|

| |

Dear ,

Parkwalk invests in UK Tech across the growth curve from early-stage through to AIM-listed, investing in companies with deeply embedded IP and freedom to operate in ther sectors. We invest in the fruits of the UK's £4.5bn publicly-funded research carried out at our universities.

|

|

|

|

| |

Sector Diversification

Parkwalk has invested in 37 companies across various sectors, ranging from clean-tech through 3D printing, big-data, software, hardware, and genomics. See our portfolio here.

|

|

|

|

|

|

| |

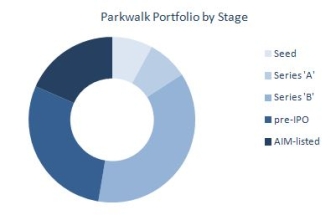

Investing across the growth curve

UK Tech Funds I-IV comprise 10% Series 'A', 42% Series 'B', 21% Pre-IPO and 27% AIM-listed companies.

|

|

|

|

|

|

| |

Returns

In under four years, both the Parkwalk UK Technology Funds I & II have each separately returned, in cash, more to investors than the total cost of their subscriptions into each Fund, and each Fund still contains current portfolio companies with the potential to offer further returns to investors as the investee companies mature.

Parkwalk also won the EIS Association 'Best Exit of the Year' for the near 10x (including tax reliefs) return our investors received in Tracsis plc.

|

|

|

|

| |

Investment Strategy

Britain punches well above its weight in R&D: with 1% of the global population Britain is responsible for 15.9% of the world's most highly cited papers.

This leads to impressive commercial prospects - the University of Cambridge alone has spun-out 14 companies with valuations of over $1bn, and two of those are over $10bn.

This sector is becoming more mainstream, with specialist funds such as IP Group plc and Imperial Innovations plc raising substantial sums from institutional investors at over 2x their net asset values to invest in this space.

Parkwalk investors participate in the same sector effectively at a discount to NAV with the tax reliefs offered under the EIS and capital gains tax freedom on profits.

There is more on our investment strategy on our website here.

|

|

|

|

| |

More Information

If you would like more information on Fund VI please reply to this email or call the funds team on 020 7759 2285.

|

|

|

|

|

|

| |

Important Information

This financial promotion is issued by Parkwalk Advisors Limited (Parkwalk), which is authorised and regulated by the Financial Conduct Authority. Investments referred to in this newsletter are not suitable for all investors. Interested parties are strongly recommended to seek specialist financial and tax advice before investing in any Parkwalk product. Capital is at risk and investors may not get back the full amount invested. Tax treatment depends on the individual circumstances of each investor and may be subject to change. Past performance is not a reliable indicator of future results, and the value of investments may go down as well as up. Projections and forecasts are also not a reliable indicator of future performance. Investments in small and unquoted companies carry a higher risk than many other forms of investment. Any investment in a Parkwalk product must only be made on the basis of the terms of the full Information Memorandum. Parkwalk is not able to provide advice as to the suitability of investing in a Parkwalk product.

|

|

|

|

|