|

| |

Dear ,

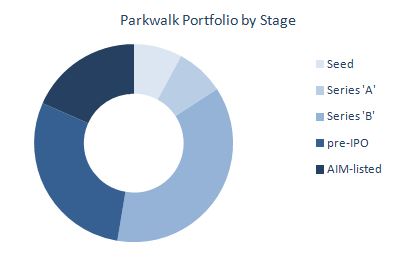

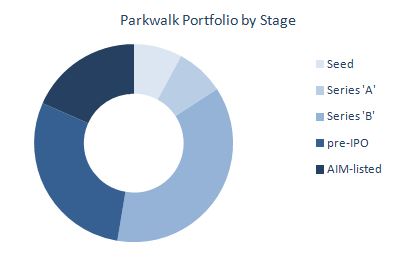

We are delighted to announce the launch of the Parkwalk VI EIS Fund, which will have a similar investment strategy to that of Parkwalk Funds I-V:

- Investing in UK technology companies, predominantly spun-out from UK Universities based on significant Intellectual Property and/or commercial know-how

- The Fund will seek to make the majority of its investments in the 2015/16 tax year

- It will seek to have a maturity profile of investments which will include at least one early stage spin-out and at least one that is already in its commercialisation phase

- It is likely the fund will invest in some follow-on financing rounds in companies other Parkwalk funds have invested in and also alongside our Opportunities and Oxford and Cambridge funds - this should allow a time-line of exits from around 4 to 8 years

- On an exit, cash will be returned to investors, less any fees due, rather than reinvested

- The fund will generally seek to invest alongside other larger financial institutions on similar terms (while complying with EIS regulations)

|

|

|

|

| |

|

|

TRACK RECORD

Parkwalk's first investments were made in 2010 and as such, Parkwalk funds, as far as returns are concerned, are still in their infancy. Despite this, we believe Parkwalk already has an impressive track record:

- Both Parkwalk Funds I and II have each had two exits, and returned, in cash, more than the total amount that investors invested in each fund. Investors still have live investments in both funds

- Parkwalk's four exits since 2010 (two with gains, two with losses) have returned 2.25x cost (3.36x including tax reliefs) giving an IRR of 42% (or 54% including tax reliefs)

- As of January 2015, Fund I (invested between September 2010 & April 2011) has a NAV gain of 1.87x times (2.15x inc tax reliefs and fees) and Fund II (invested between May 2011 & April 2012) a gain of 2.37x times (2.94x inc tax reliefs and fees)

- Parkwalk had exited 44% of its investments which are currently over 3 years old (the minimum holding period for the EIS) highlighting Parkwalk's motivation to bring returns to investors in as short a time as possible

Past performance is not necessarily a guide to future performance and may not necessarily be repeated

|

|

|

|

|

| |

PARKWALK FUND MANAGEMENT PHILOSOPHY

Parkwalk seeks to align itself with the investor. We believe our track record highlights this. Both employees and managers of Parkwalk invest in our funds, in the same structure and shares as our investors.

Consistent with this philosophy, Parkwalk’s fees are predominantly performance driven. Parkwalk generally does not charge fees to investee companies.

As a result of these two policies, Parkwalk is incentivised to seek high cash returns in order to trigger performance fees.

INVESTING IN THIS SECTOR

2014 was an interesting year for UK University spin-outs as an asset class. Over $500m was raised in the UK last year by four fund managers and institutions, taking their listed valuations to over $4bn. Highlights included IP Group raising $165m at nearly 2 times NAV and Allied Minds listing in London at a $670m valuation (at potentially 3 or 4 times NAV).

These fund-raises were backed by the likes of Woodford, Invesco Perpetual, Landsdowne and Baillie Gifford.

Parkwalk has investments directly alongside such Funds as Woodford and Invesco (Xeros, Revolymer) and indirectly with their investments in IP Group and Imperial Innovations.

Parkwalk EIS Funds invest in the same sector with our investors' effectively receiving a 30% discount to NAV once the tax reliefs of the EIS have been taken into account.

PARKWALK PROCESS & TIMING

Investors' subscriptions and shares are held at The Share Centre, the Funds' custodian and nominee.

in 2013/14, it took Parkwalk an average of approximately 8 months to fully deploy investors' subscriptions into underlying portfolio companies.

In 2014, we made 24 investments and the average time it took to send EIS3s to individual investors was 2.5 months, with the shortest being one month and the longest 5 months (for an AIM-listed investment).

EIS TAX RELIEFS

The EIS offers UK taxpayers the following benefits:

- 30% Upfront Income Tax Relief

- Tax-Free Capital Gains

- Loss Relief of up to 61.5% for a 45% taxpayer

- CGT Deferral Relief

- IHT Exemption after 2 years

Please contact funds@parkwalkadvisors.com or call the funds team on 020 7759 2285 if you would like further details on the Parkwalk UK Tech Fund VI.

Regards,

The Parkwalk Team

|

|

|

|

| |

Important Information

This financial promotion is issued by Parkwalk Advisors Limited (Parkwalk), which is authorised and regulated by the Financial Conduct Authority. Investments referred to in this newsletter are not suitable for all investors. Interested parties are strongly recommended to seek specialist financial and tax advice before investing in any Parkwalk product. Capital is at risk and investors may not get back the full amount invested. Tax treatment depends on the individual circumstances of each investor and may be subject to change. Past performance is not a reliable indicator of future results, and the value of investments may go down as well as up. Projections and forecasts are also not a reliable indicator of future performance. Investments in small and unquoted companies carry a higher risk than many other forms of investment. Any investment in a Parkwalk product must only be made on the basis of the terms of the full Information Memorandum. Parkwalk is not able to provide advice as to the suitability of investing in a Parkwalk product.

|

|

|

|

|