Friday Thoughts

New ‘all time highs’ – what’s the significance….?

We have heard it again this week in the US regarding the S&P 500, and it may not be long before we hear it here in the UK regarding the FTSE 100.

Financials and Tech stocks have been making gains following positive economic reports and strong earnings.

The term itself seems to automatically triggers some sort of hysteria, suggesting that things are due to tip the other way any second. We inately believe that over short periods of time that random occurences are meant to balance out. That 10 straight coin flips on heads should virtually assure that a tail will be next, despite the fact that nothing that came before it matters.

This is a cognitive defect we have, known as the Gambler’s Fallacy.

The American gangster, Bugsy Siegel, in 1945 figured this out before it even had a name and so he showed up in the middle of the Nevada desert to capitalise on it.

An entire city sprouted up virtually overnight, and Vegas lives to this day because of that exact reason.

If only the world didn’t work this way.

Anytime we saw something unprecedented take place, such as new stock price highs, we’d simply bet the other way.

Of course in reality, doing this would wipe us out completely and permanently.

There is more meaning to an all time high than meets the eye.

It means that people paid a price that no one before them was willing to pay.

It means no one has a loss in the stock.

It means those waiting for a pullback to get in are now ripping their hair out.

It means it is now the new favourite stock, a winner, that people will not part with easily.

It means every single analyst downgrade or estimate revision has been instantly invalidated, and was a waste of ink.

Finally however, it means that the stock must now be on it’s best behaviour from here on.

There will be more margined up positions than ever before.

Starting off the movie theme of todays note, and the advice received by Bud Fox – ‘kid, you’re on a roll, enjoy it while it lasts, cos it never does….’

But this does not mean the coin is about to flip tails.

And so while 100,000 yrs of evolutionary programming may lead us to believe that a new all time high is a precarious perch, it isnt ever quite that simple.

Just don’t be scared of it….

So, what to do if you are seeing these headlines….??

We all know about last years market performances, however, less than 50% of those in the UK (52% in US) are personally invested in the stock market.

Many investors, still reeling/scarred from the financial crisis chose to stay on the sidelines and missed it.

Inevitably, these folk are now kicking themselves, but are equally worried about a correction and stepping in at the top (as above, gambler’s fallacy etc).

After such a rally, and in this situation it is likely that investors will make one of 2 mistakes.

1. Extrapolate from last year’s returns and take on too much risk.

2. Look at the recent run and decide to wait til the market ‘pulls back’.

Really, what investors should do is something in between.

1. Develop an investment plan that meets their timeline, goals, objectives and risk tolerance, and rebalance it continously……leaving a portion of cash for ‘opportunism’

2. Accept that if you want to grow your wealth it will have to involve some amount of risk exposure….there is no risk-free way to do this. That was true last year, it is true today, and will be true 100 yrs from now….

S&P 500 – 10 yr

Currencies

2014 – year of the dollar?

Blackrock published a note this week on the US dollar over the coming 12 months or so.

There were 3 key poing which they made pointing to an expected strong performance.

1. Improving US economy – Significantly more than that of other developed countries. US 2.5-2.75%, less than 2% Japan, and 1% for Europe.

2. Fed policy – The Fed will be pulling back when many other central banks will need to maintain a loose monetary policy. There is no way Europe, Japan, China central banks will be tightening. In contrast, by year end the Fed is expected to have exited its QE programme. The Bank of England, and sterling, is the only possible exception.

3. Valuation – Many of the key developed market currencies still look expensive relative to the dollar, based on purchasing power. Swiss Franc and Aussie dollar look to be 25% overvalued v Dollar.

The most significant point, and likely to have most effect is Fed policy.

And since FX is untimately a relative value game, you have to consider how interest rates and central bank policy will come into play.

Dollar X-rate 10 yr

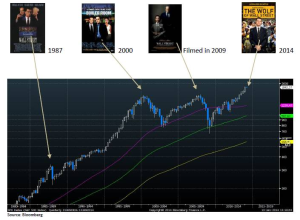

The ‘Hollywood Top’

How’s this for an indicator??

Every time a film comes out about ‘Wall St’ the market crashes??

Unfortunately not quite a full-proof stratgey…..!

Arbitrage came out in 2012, and Margin Call in 2011…..wasn’t quite the top then…….

And, of course, the greatest of all trading movies – Trading Places. This doesn’t appear as it came out in 1983, the very start of the greatest bull run of all time….

Other bits of interest…..